How to Set Up a Business in Vietnam: A Step-by-Step Guide (2025)

28/06/2025

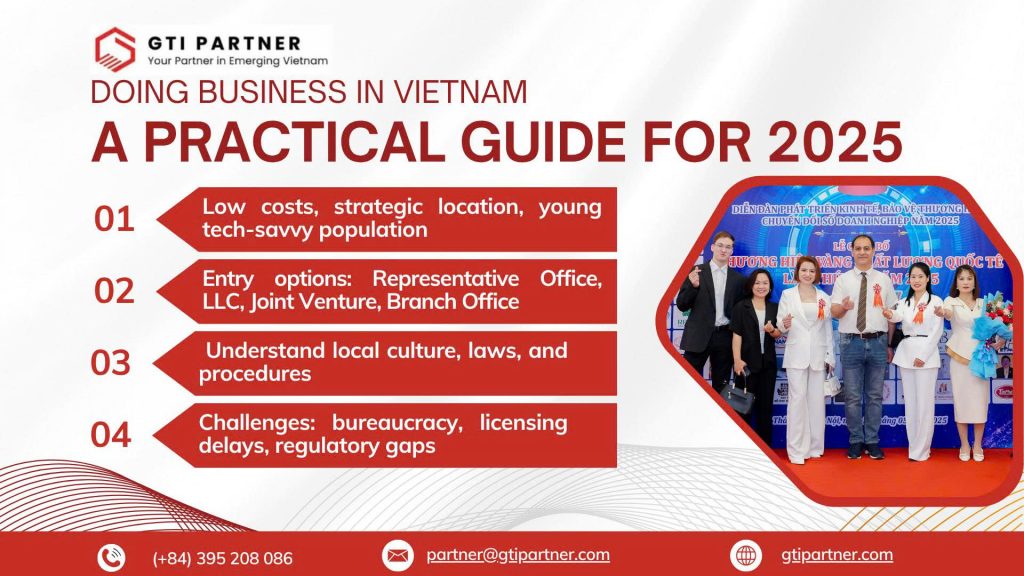

Vietnam is one of the most attractive destinations for foreign direct investment (FDI), thanks to its strategic location, competitive labor costs, and a government committed to economic growth. This guide will walk European and Middle Eastern SMEs through the essential steps for business setup in Vietnam.

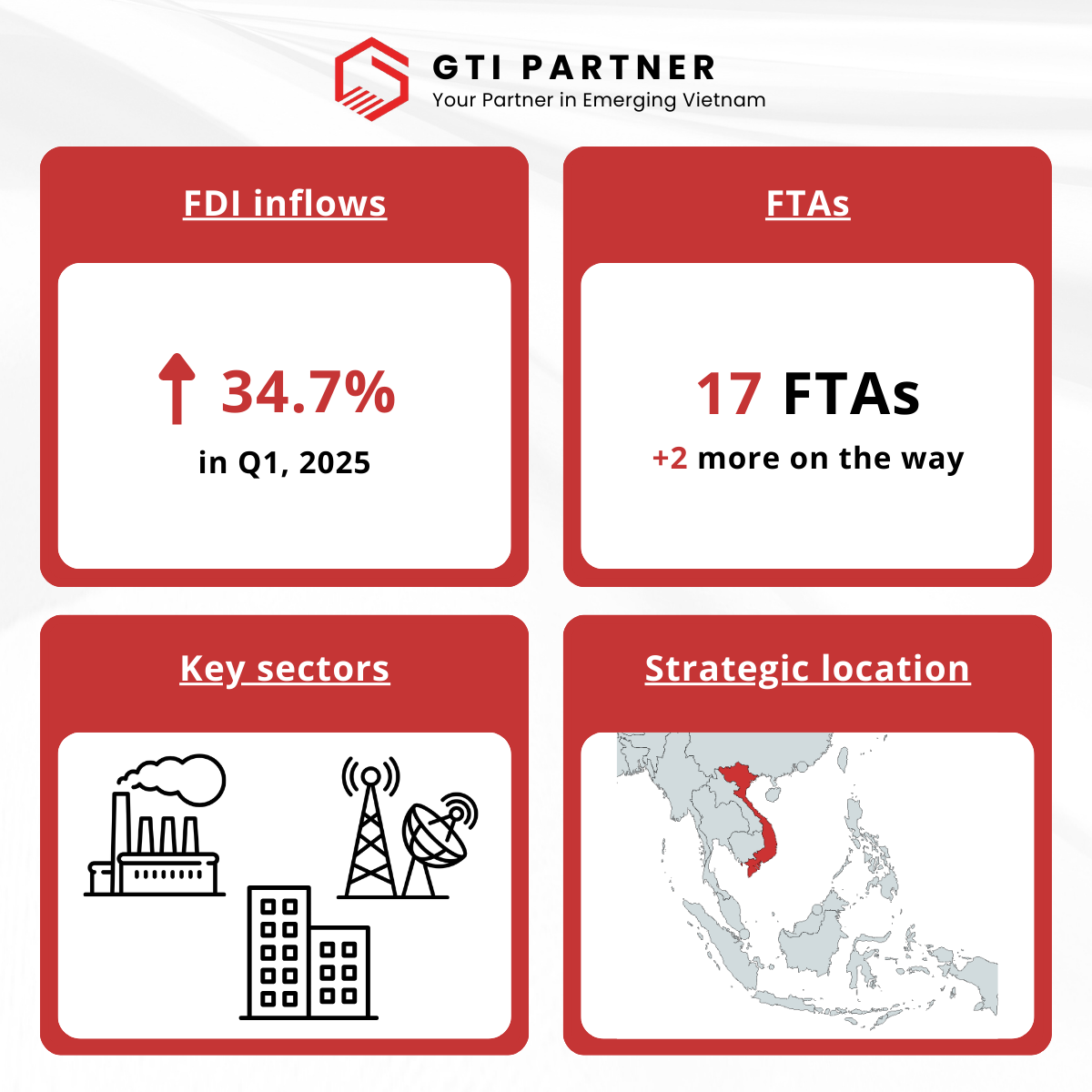

Why Invest in Vietnam?

- Strategic Location: Proximity to ASEAN, China, and key shipping routes.

- Growing Economy: Consistent GDP growth and a stable investment environment.

- Competitive Workforce: Young, educated, and cost-effective labor pool.

- Free Trade Agreements: Access to EU-Vietnam (EVFTA) & UAE-Vietnam (CEPA), CPTPP, and RCEP.

Step 1: Choose Your Business Structure

Foreign investors can establish:

- Limited Liability Company (LLC): Most common for SMEs, allows 100% foreign ownership.

- Joint Venture (JV): Partnership with a local firm, useful in restricted sectors.

- Representative Office: For market research and liaison, not for revenue generation.

Tip: Consult with a market entry advisor to select the best structure for your sector and goals.

Step 2: Prepare Required Documentation

- Valid passport copies of investors.

- Proposed company name and charter.

- Lease agreement for office space in Vietnam.

- Investment registration application.

- Feasibility study (recommended for certain sectors).

Step 3: Obtain an Investment Registration Certificate (IRC)

File an application with the Department of Planning and Investment (DPI) in the intended province. The IRC grants approval for your foreign investment project in Vietnam.

Timeline: 15–30 working days, depending on the province and sector.

Step 4: Obtain the Enterprise Registration Certificate (ERC)

Once you receive the IRC, apply for the ERC to officially register your company and receive a tax code.

Timeline: 5–10 working days.

Step 5: Open a Bank Account and Capital Contribution

- Open a capital account with a licensed Vietnamese bank.

- Transfer the charter capital within 90 days of ERC issuance.

Step 6: Apply for Additional Licenses

Depending on your industry, you may need:

- Trading licenses

- Import/export permits

- Food safety certifications (for F&B)

- Construction permits

Tip: Your market entry consultant can manage these efficiently to avoid delays.

Step 7: Post-Incorporation Compliance

- Register employees with social insurance.

- Set up accounting and tax reporting systems in compliance with Vietnamese law.

- File monthly/quarterly VAT and CIT reports.

- Prepare annual audit reports.

Common Challenges for Foreign SMEs

✅ Understanding local regulations and licensing requirements.

✅ Navigating cultural and business environment differences.

✅ Identifying reliable local partners or suppliers.

✅ Managing ongoing compliance and accounting standards.