Navigating Vietnam’s Trans-shipment Regulations: A Guide for Foreign Enterprises

15/08/2025

Vietnam’s integration into the global economy has opened tremendous opportunities for international businesses. Yet, certain regulatory frameworks—particularly around trans-shipment activities—require careful navigation to ensure compliance and avoid costly setbacks.

In Emidas Magazine’s latest edition, GTI Partner sheds light on the rules, limitations, and practical considerations for foreign enterprises engaging in trans-shipment within Vietnam.

What is Trans-shipment and Why It Matters

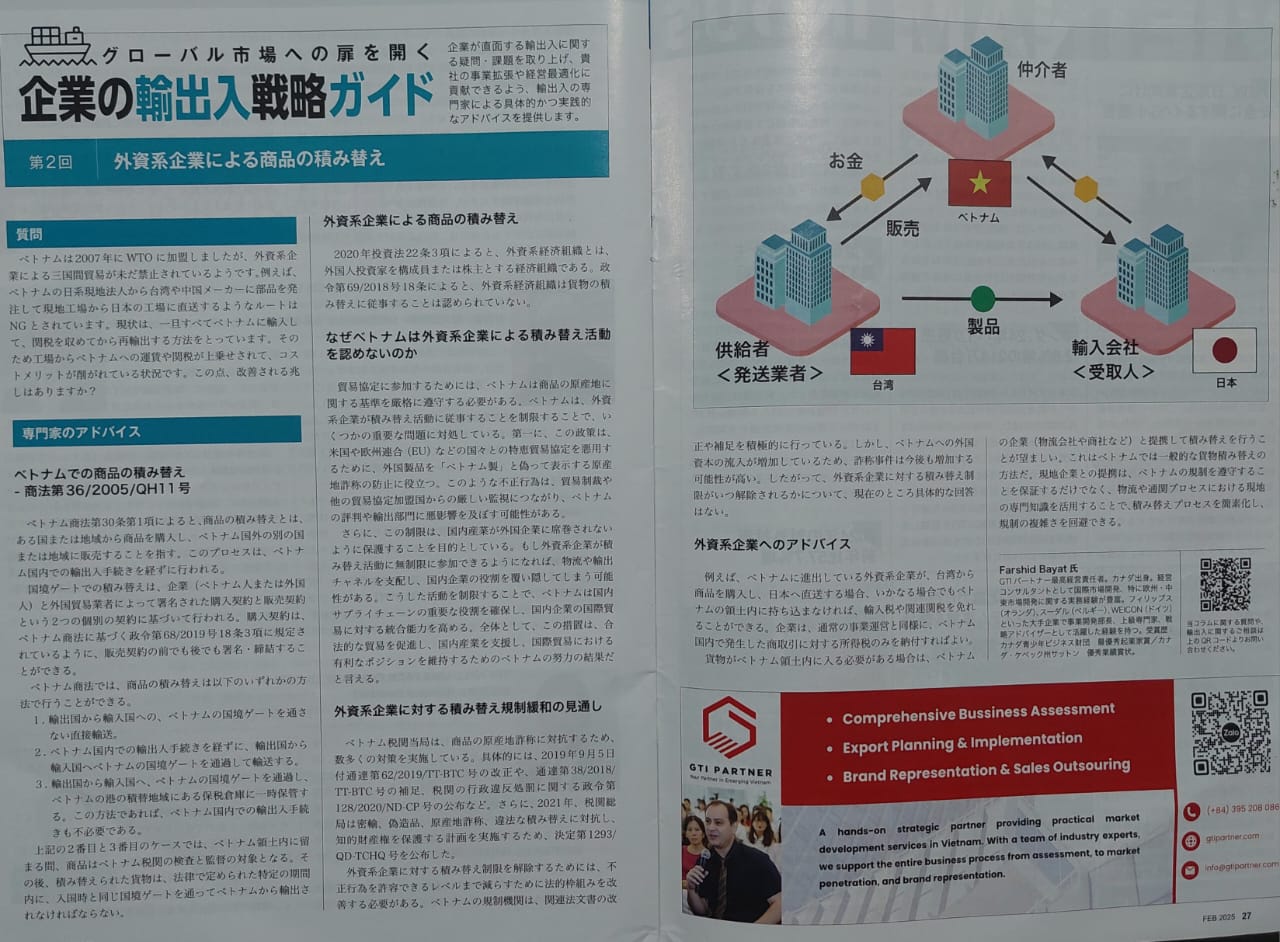

Trans-shipment involves goods being shipped through Vietnam from a supplier in one country to a buyer in another, without the goods being consumed or processed in Vietnam.

For example:

-

Supplier: Taiwan

-

Buyer: Japan

-

Intermediary Location: Vietnam

While common in global trade, this process in Vietnam is subject to specific legal restrictions, especially for foreign-invested enterprises (FIEs).

Read GTI Partner’s full (Japanese-language) article in Emidas (pages 26-27)

Why Foreign Enterprises Face Restrictions

Under Vietnam’s Commercial Law and related regulations, FIEs are generally not permitted to conduct pure trans-shipment activities—where goods simply pass through Vietnam without import/export procedures.

This is to:

-

Protect domestic trade and customs systems

-

Maintain accurate trade statistics

-

Ensure compliance with import/export tax frameworks

The Legal Framework You Must Know

Key legislative points include:

- Law No. 36/2005/QH11 – Vietnam’s Commercial Law sets the foundation for goods trading and related activities.

- Decree 69/2018/ND-CP and Decree 09/2018/ND-CP – Outline detailed rules on foreign business rights and conditions for trading in goods.

- Circular 11/2020/TT-BCT – Provides guidance on the implementation of trading rights for FIEs.

Foreign enterprises intending to move goods through Vietnam must structure transactions carefully—often involving licensed local entities to handle import/export stages.

Practical Advice for Businesses

GTI Partner recommends:

-

Early Legal Review – Assess your transaction model against Vietnam’s trade laws before signing contracts.

-

Partnering with Local Experts – Engage Vietnamese intermediaries who hold the necessary trading licenses.

-

Optimizing Trade Routes – Where possible, adapt supply chains to include compliant import/export steps in Vietnam.

How GTI Partner Can Help

Our team provides end-to-end market entry and compliance support:

-

Regulatory assessment of planned transactions

-

Structuring of compliant supply chain and sales channels

-

Coordination with customs, licensing authorities, and local partners

We ensure your business not only meets legal requirements but also maximizes efficiency and profitability in the ASEAN trade environment.

📞 Contact GTI Partner to discuss your Vietnam transhipment and trade strategies.

.