🇻🇳🌏 Vietnam’s Logistics and E-commerce Boom: The Next Frontier for ASEAN Growth

24/10/2025

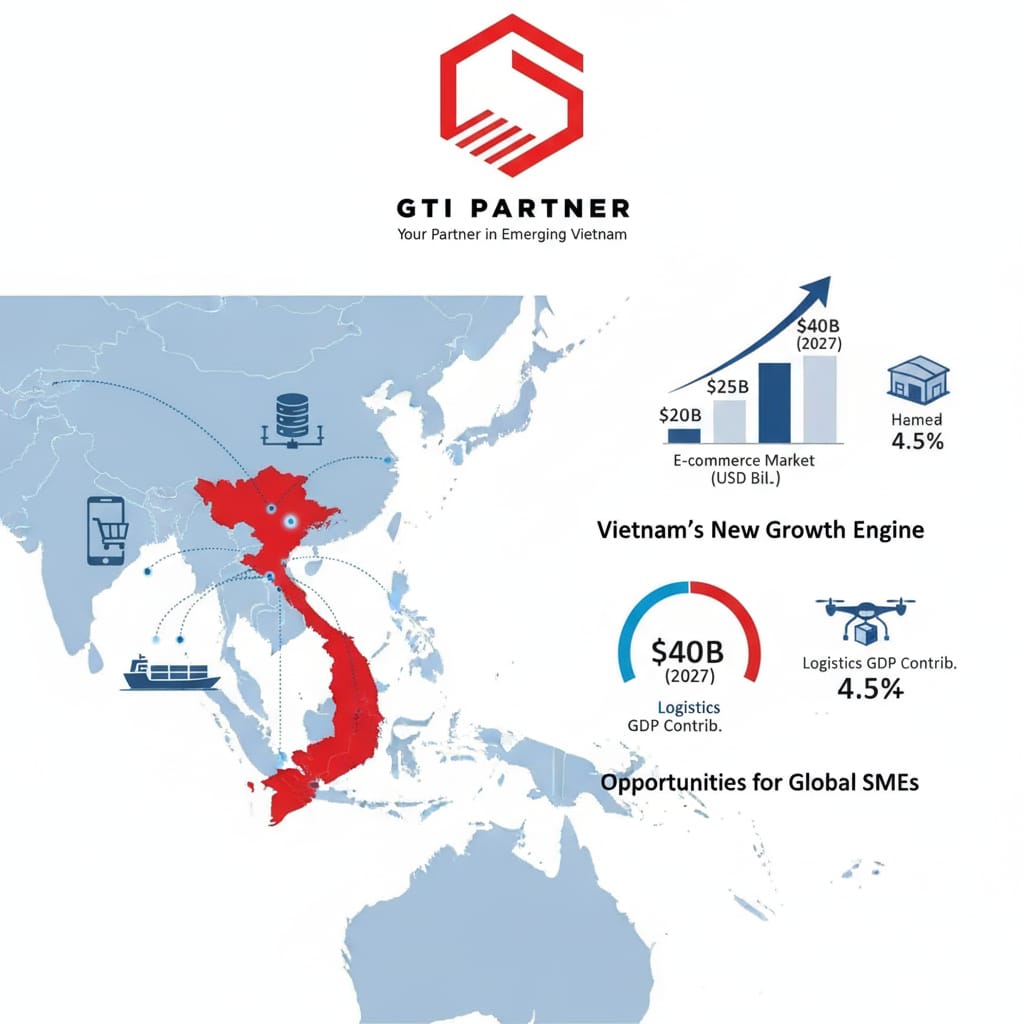

Vietnam’s New Growth Engine

Vietnam has rapidly evolved into one of ASEAN’s fastest-growing logistics and e-commerce markets. Fueled by rising consumer demand, regional integration, and strong FDI inflows, the country is redefining its role in Asia’s digital supply chain.

According to the Ministry of Industry and Trade, Vietnam’s e-commerce market surpassed USD 25 billion in 2024, growing nearly 20% year-on-year, with projections reaching USD 40 billion by 2027. Simultaneously, logistics now contributes over 4.5% to national GDP, supported by infrastructure upgrades and foreign investment from global logistics leaders such as DHL, Maersk, and CJ Logistics.

Key Growth Drivers

Digitalization and Mobile Commerce

With over 77% internet penetration and one of Asia’s youngest digital populations, Vietnamese consumers are increasingly shopping online. Platforms such as Shopee, Lazada, and TikTok Shop are seeing record sales volumes — supported by efficient last-mile delivery solutions and digital payment systems.

Strategic ASEAN Connectivity

Vietnam’s location makes it a central logistics hub linking China, ASEAN, and global trade routes. The ongoing expansion of deep-water ports (Cai Mep–Thi Vai), new expressways, and cross-border e-commerce zones near Lang Son and Lao Cai are positioning Vietnam as a critical gateway for regional trade.

Government Push for Smart Logistics

The Vietnamese government’s “National Logistics Development Strategy 2030” focuses on digital transformation, warehouse automation, and multimodal connectivity. Incentives and tax breaks are encouraging SMEs and foreign partners to invest in technology-driven logistics solutions.

Opportunities for Global SMEs

Global SMEs can leverage Vietnam’s growth momentum in several key areas:

- Cross-border fulfillment and distribution hubs

- Green and smart warehouse operations

- Cold chain logistics for food and pharmaceuticals

- Digital platforms for e-commerce analytics and payments

By partnering with local providers or establishing regional offices, foreign investors can capture the dual advantage of ASEAN market access and Vietnam’s competitive operational base.

Challenges and the Road Ahead

While opportunities abound, challenges persist — including fragmented logistics infrastructure, regulatory inconsistencies, and intense competition in the e-commerce space. Success requires strategic localization, strong partnerships, and cultural understanding — areas where expert guidance makes all the difference.

Conclusion

Vietnam’s logistics and e-commerce boom isn’t just a local success story — it’s an ASEAN-wide opportunity. For SMEs seeking scalable growth, Vietnam offers a unique mix of strategic geography, tech-driven consumer demand, and supportive policy frameworks.