Doing Business in Vietnam: A Practical Guide for 2025

26/07/2025

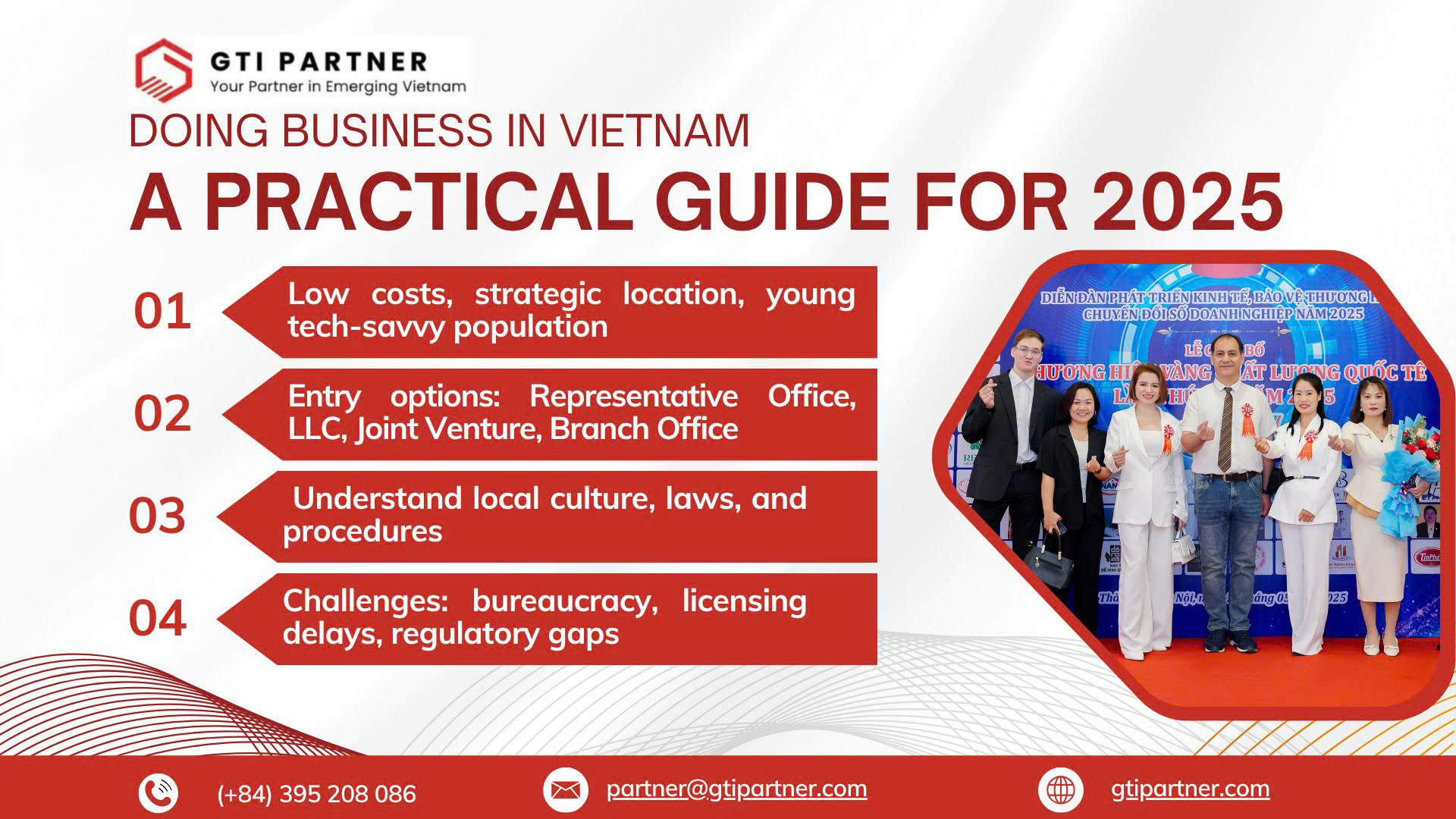

Vietnam continues to attract global investors and SMEs seeking growth in Asia. With stable GDP growth (projected 5.5–6% in 2025), a young, tech-savvy population, and strategic location, Vietnam offers opportunities across manufacturing, consumer goods, renewable energy, logistics, and digital services.

However, doing business in Vietnam requires preparation and localized understanding to navigate regulations, culture, and operational challenges.

Here’s your practical summary guide for entering and expanding in Vietnam in 2025:

📘 Download the Full Guide:

For a comprehensive overview, download Guide to Doing Business in Vietnam (PDF) — including taxation and banking insights for 2025.

1️⃣ Why Vietnam in 2025?

✅ Strategic location near major supply chains in Asia.

✅ Competitive labor costs with an increasingly skilled workforce.

✅ Active participation in FTAs (RCEP, CPTPP, CEPA with UAE) providing market access advantages.

✅ Growing consumer market with rising middle-class demand.

✅ Government support for FDI in high-tech, renewable energy, and supporting industries.

2️⃣ Business Entry Options in Vietnam

- Representative Office: Low-risk market presence, limited to liaison activities.

- Limited Liability Company (LLC): Full foreign ownership in many sectors, with control over operations.

- Joint Venture: Required in some sectors (e.g., certain logistics areas), beneficial for market knowledge and network.

- Branch Office: Allowed in specific sectors (banking, legal, etc.).

3️⃣ Key Regulatory Considerations

✅ Business registration with MPI and licensing compliance.

✅ Tax obligations: CIT (20%), VAT (10% standard), PIT for employees.

✅ Sector-specific licensing (e.g., food safety, ICT).

✅ Local labor law compliance and employee contracts.

4️⃣ Cultural & Business Practices

- Relationship-building (“Guanxi”) is essential for partnerships and negotiations.

- Decision-making may require multiple meetings and consensus-building.

- Localized marketing and communication are vital due to consumer preferences and trust-building.

5️⃣ Common Challenges

❌ Navigating complex procedures and administrative requirements.

❌ Delays in licensing without local support.

❌ Differences in standards and regulations from home markets.

❌ Supply chain and logistics challenges in certain provinces.

6️⃣ How GTI Partner Can Help

At GTI Partner, we help EMEA businesses and investors:

✅ Assess market readiness before entry.

✅ Navigate regulatory registration and licensing.

✅ Identify reliable local partners and distributors.

✅ Build market entry and sales strategies aligned with sector dynamics.

✅ Manage HR, compliance, and ongoing operational support.

📘 Download the Full Guide: Guide to Doing Business in Vietnam (PDF)

🏃♂️💼 Ready to Explore Vietnam in 2025?

Vietnam offers vast potential, but a structured, localized approach is essential for success. Whether you are exploring sourcing, manufacturing, distribution, or investment, GTI Partner is your reliable Vietnam expansion advisor.

👉 Contact us to schedule a Vietnam Market Entry Consultation.