Why 2025 Is the Year SMEs Should Invest in Vietnam

30/07/2025

With Vietnam’s economy on a historic growth path, now is the ideal time for international SMEs—especially those from Europe and the Middle East—to enter Vietnam. GTI Partner’s new market readiness guide helps businesses seize this opportunity.

📊 Vietnam’s Growth Momentum in 2025

-

Vietnam’s GDP is projected to grow between 6.2–6.8% in 2025 World Bank

-

In H1 2025, GDP rose 7.52%, the fastest pace in 15 years Vietnam Briefing

-

The manufacturing sector is set to reach over US $108 billion by year-end Vietnam Briefing

-

Vietnam also leads ASEAN with about 98% of registered businesses being SMEs, playing a critical role in the economy World Bank

🌐 Why SMEs Are Choosing Vietnam in 2025

-

Cost-Efficient Operations: Labor costs remain 50% lower than China, enabling competitive production scale Vietnam Briefing

-

Digital & E-Commerce Growth: Expected to surpass US $25 billion in 2025, largely driven by social commerce and online retail platforms like Shopee and TikTok Shop

-

Tech-Ready Workforce & Reforms: SMEs are rapidly digitizing, with 90% using digital tools and adopting AI-supported operations UOB Business Outlook

🚧 Common Market Entry Challenges

Even as Vietnam thrives, foreign SMEs still face hurdles such as:

-

Complex licensing, investor approvals, and legal compliance

-

Finding reliable local partners or distributors

-

Cultural and consumer behavior differences in strategy and negotiation

-

Supply chain infrastructure limitations outside major urban centers

✅ How GTI Partner Helps You Enter Vietnam with Confidence

We support SMEs with a proven market entry framework:

Our Services Include:

-

Market readiness assessments & entry strategy

-

Company registration and licensing

-

FDI and compliance advisory

-

Partner sourcing and export planning

-

On-ground business development support

Our clients benefit from hands‑on guidance to reduce risk, ensure local-market fit, and accelerate growth.

📌 Practical Insights for 2025

-

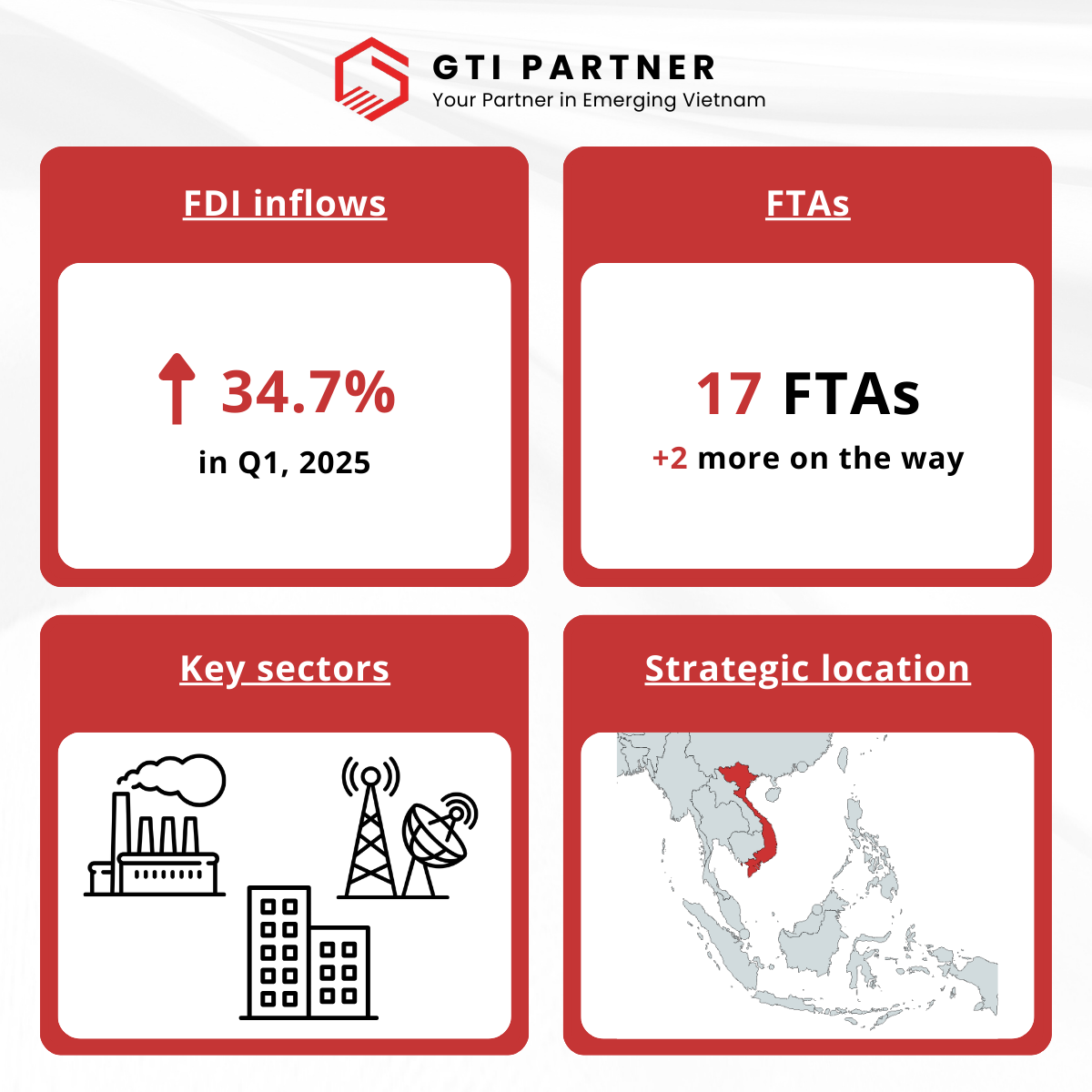

Focus on green industries, agritech, ICT, and digital services—these sectors are unlocking major FDI investment

-

Leverage trade agreements (CPTPP, EVFTA) to access global markets

-

Build local marketing and sales strategies aligned with emerging Vietnamese consumer behavior, especially via social commerce and mobile channels Vietnam Investment Review Vietnam Briefinglinkedin

⚡ Ready to Enter Vietnam in 2025?

Let GTI Partner design a tailored entry strategy—win market access, build local partnerships, and ensure operational compliance.

👉 Contact GTI Partner’s team for further information and enquiries